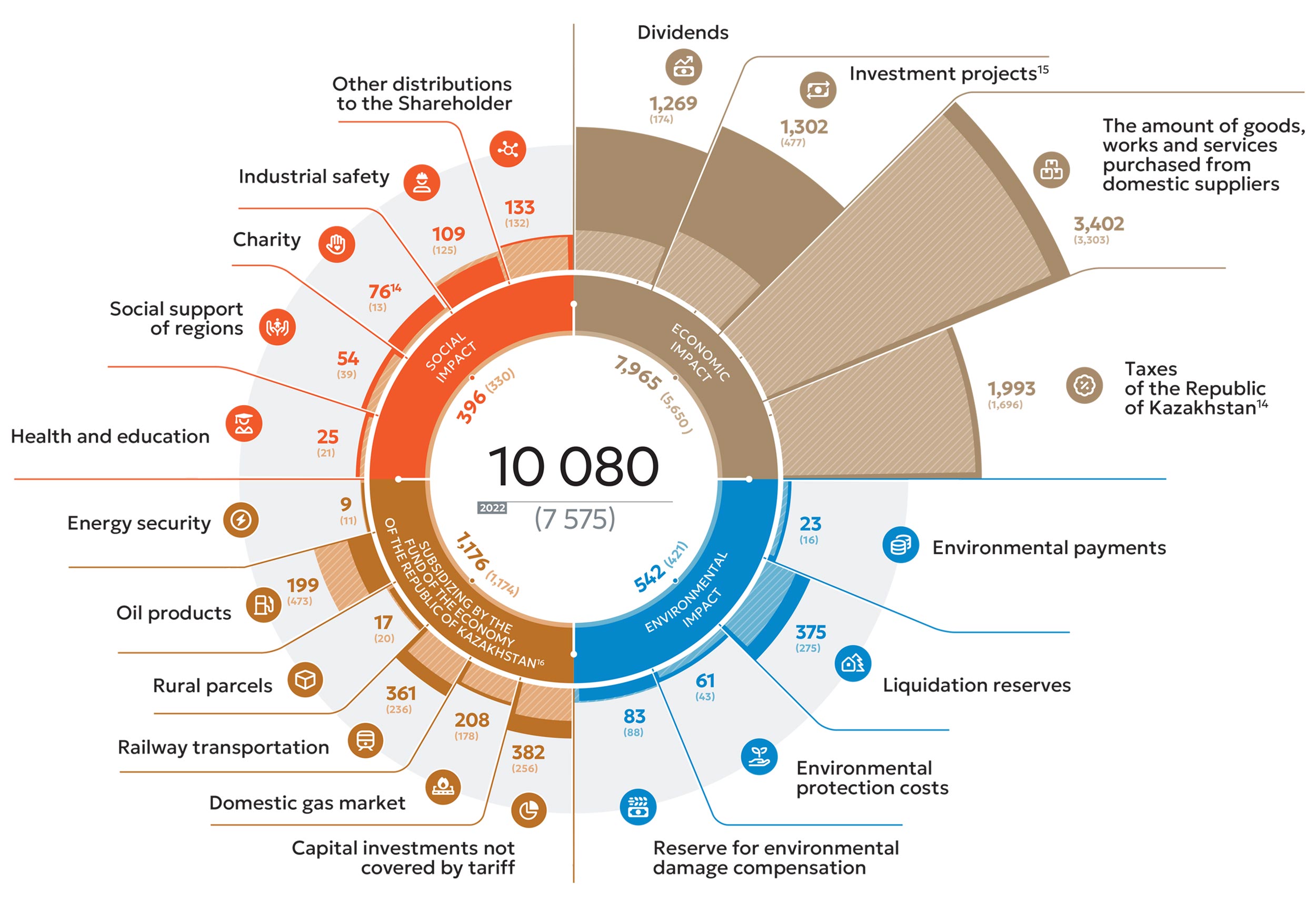

Impact matrix

Impact matrix, KZT billion

GRI 203-1 GRI 203-2

14 Excluding Individual Income Tax.

15 Excluding VAT, on an accrual basis.

16 Cross-subsidization of socially significant areas by the Fund to curb the rise in prices and tariffs.

17 Subsidizing is expressed in lost profits of oil producing companies due to the difference in export and regulated domestic prices for the volume of oil supplied to the domestic market minus export customs duties and transportation (netback).

18 The costs approved by the Committee for Regulation of Natural Monopolies of the Ministry of National Economy of the Republic of Kazakhstan (CRNM) in the tariff estimate do not cover the actual costs of freight and passenger transportation on intra-republican traffic at regulated tariffs of JSC National Company Kazakhstan Temir Zholy (KTZ) for the services of the main railway network and locomotive traction. Accordingly, subsidies were calculated as the difference between actual costs and the costs of regulated services approved in the tariff estimate.

19 The actual costs of purchasing and transporting gas exceed the revenues at the approved tariffs for commercial gas on the domestic market. Thus, subsidizing is revenue minus the cost of gas and transportation costs.

20 Capital investments not covered by approved tariffs are calculated as the difference between capital costs approved by CRNM and actual capital costs.

21 Including distributions to the Public Fund “Kazakhstan Khalkyna,” according to the accrual method.