Financial results and sustainable growth

The Fund Group’s assets at the end of 2023 amounted to KZT 36.9 trillion, 9.8% more than in 2022 (KZT 33.6 trillion). Revenues increased by 3% and reached KZT 17.2 trillion.

Created and distributed direct economic value, KZT billion24 GRI 201-1

| Indicator | 2020 | 2021 | 202225 | 2023 |

|---|---|---|---|---|

| The direct economic value created | ||||

| Total revenues26 | 9,557 | 13,179 | 16,705 | 17,218 |

| Distributed economic value | ||||

| Total costs27 | -8,974 | -11,270 | -14,331 | -15,090 |

| Retained economic value | ||||

| Profit | 583 | 1,908 | 2,374 | 2,128 |

| Including profit per Shareholder’s share | 558 | 1,629 | 21,927 | 1,698 |

| Payments to the state28 | -1,523 | -2,065 | -2,630 | -2,941 |

| Payments to capital suppliers29 | -252 | -248 | -306 | -1,469 |

| Capital investments | 1,434 | 1,572 | 1,880 | 2,747 |

24 Following the GRI recommendations on disclosure 201-1, the Fund's financial statements prepared following IFRS were used to prepare the table

25 Financial data for 2022 have been restated following the Consolidated Financial Statements of 2023.

26 Total revenue and other income in the statement of comprehensive income.

27 Total expenses and expenses in the statement of comprehensive income.

28 Payments to the budget and CIT in all regions of the Fund Group's activities.

29 Includes dividends and other distributions.

Credit ratings support our stable financial results:

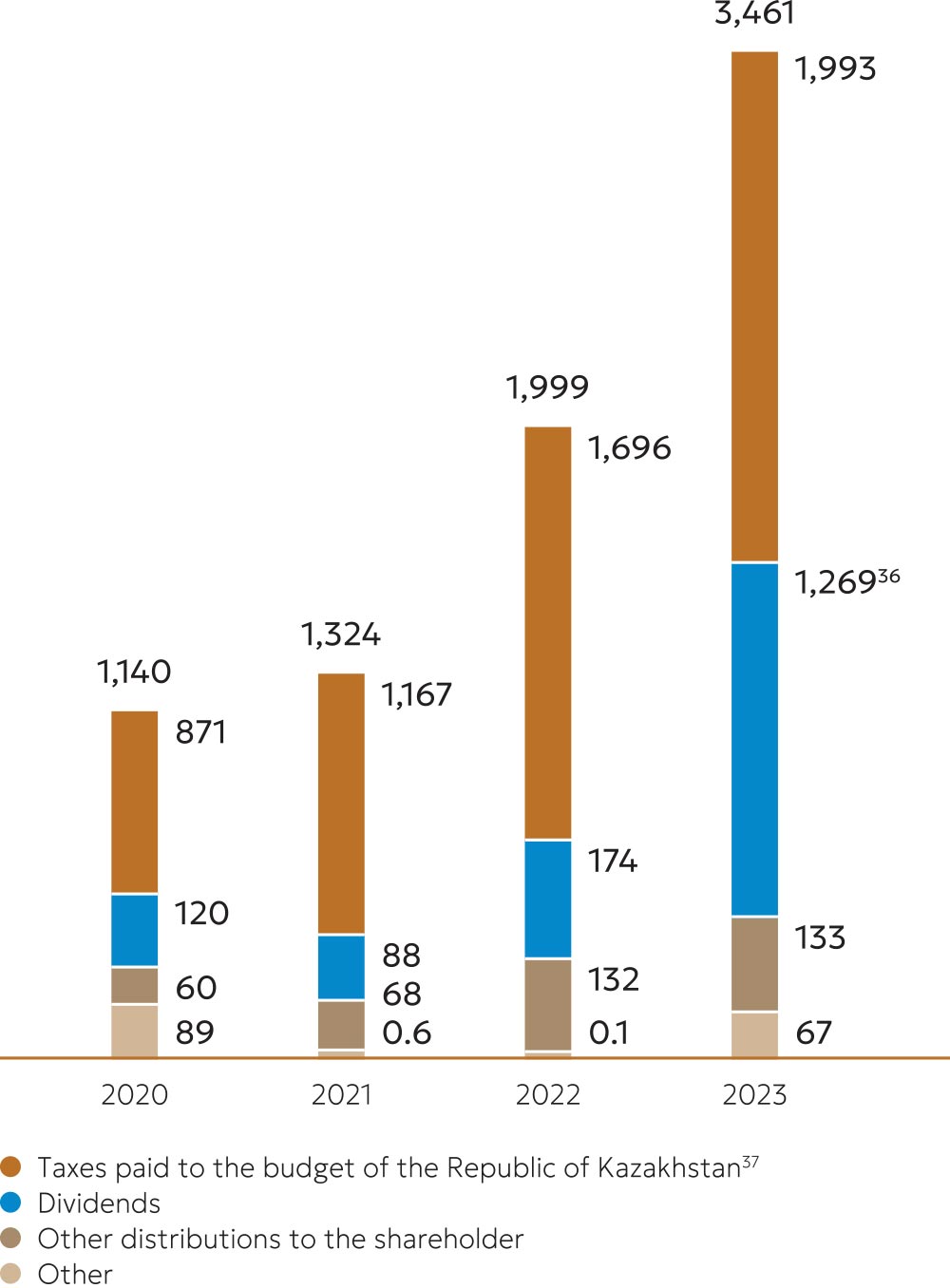

Dividends and other payments to the budget

Payments to the state RoK, KZT billion

36 In addition to payments based on the results of 2022, during the period from October to November 2023, the Fund, following the Government Decree dated October 20, 2023, paid dividends to the Shareholder in the amount of KZT 1,026.7 billion from retained earnings of 2021.

37 Excluding individual income tax.