Initiatives to reduce climate impacts

The global development trend in the modern world is the transition from the industrial agenda to the climate agenda.

The international community’s attention is focused on the transformation of energy resource consumption. The pressure on coal companies and the decommissioning of coal combustion plants have a substantial impact on the Fund, as coal mining, generation, and utilization of electricity generated through coal combustion play a significant role in the Fund Group’s production processes (coal accounts for about 61% in the Fund’s energy consumption structure).

We recognize the need to reduce the growing pressure on the climate and the environment, are focused on the climate goals defined by the country and support the initiative to achieve carbon neutrality for the Republic of Kazakhstan by 2060.

The Fund’s Group of companies is collectively responsible for about 15% of the total CO2 emissions in the country.

For us, the transition to low-carbon development is a strategic objective to increase sustainability and strengthen competitiveness.

On the way to decarbonization, we rely on a systematic and reasonable transition to low-carbon technologies without abandoning traditional energy carriers. The commissioning of additional conventional capacity will ensure the stability and reliability of the country's energy system and maintain the operation of less stable RES.

Samruk-Kazyna JSC has set a strategic goal to reduce carbon dioxide emissions by 10% by 2032 compared to 2021. The Fund’s long-term goal is to achieve carbon neutrality by 2060. A Low-Carbon Vision has been approved, including a Low-Carbon Business Model Transition Plan.

Pillar one: Alternative energy and low-carbon technologies

In 2023, a delegation of Samruk-Kazyna JSC participated in the 28th UN Climate Change Conference (COP 28). As part of the conference, several business negotiations were held and agreements were reached with international partners regarding developing green energy and introducing new digital technologies in Kazakhstan. We concluded a Memorandum on the development of low-carbon energy with a total capacity of 10 GW in Kazakhstan together with the Ministry of Energy of the Republic of Kazakhstan and the Ministry of Investment of the UAE.

To reduce the negative impact on the environment, projects are being implemented to replace coal with gas at Almaty CHPPs. Implementing gasification projects will ensure the reduction of carbon dioxide emissions and harmful substances into the atmosphere in the Almaty region, increasing the capacity and reliability of heating and electrification.

We are working on a pilot project to capture, store, and use carbon dioxide (CCUS) and identify the potential for injecting it to enhance oil recovery from depleted oil reservoirs.

All portfolio companies aim to convert petrol vehicles to electric vehicles gradually.

Pillar two: Resource efficiency and emissions management technologies

In this direction, the key challenge is the reduction of methane emissions. In the oil and gas production and refining sector, a methane management system is being introduced and measures under the Global Methane Pledge are being implemented. In 2023, JSC NC KazMunayGas joined the UNEP OGMP 2.0 methane initiative, which implies voluntary commitments to reduce methane emissions and reporting. JSC NC KazMunayGas is gradually implementing a methane management system (it is planned to inventory methane emissions using the MIST program, develop the Instruction on methane leak detection, implement the leak detection and repair program, etc.).

One of the most important tasks to reduce emissions into the atmospheric air is to increase the beneficial use and utilization of raw gas, minimizing gas flaring in the oil and gas production and processing sector, as one of the largest emitters of pollutant emissions in the Fund. JSC NC KazMunayGas in 2015 supported the World Bank’s initiative “Full utilization of associated petroleum gas by 2030” to minimize the volume of regular flaring of crude gas. The Company annually reports on the volume of flaring of raw gas at the World Bank office in Kazakhstan.

In recent years, several measures have been implemented to increase the valuable utilization of raw gas, and this indicator has been improved to 98.9% by the end of 2023.

Samruk-Energy JSC and Nazarbayev University are conducting R&D on the possibilities of using CO2 capture and storage (CCS) technology.

One of the main directions is to compensate for emissions by implementing offset projects. In 2020-2022, First Wind Power Plant LLP received 238.7 thousand tonnes of CO2-eq offset units, and in the future, it is planned to issue and implement I-REC certificates.

In 2023, Energiya Semirechiya LLP received 68.4 thousand tonnes of CO2-eq offset units, and for 2022 at the Wind Power Plant, it is planned to implement carbon offsets.

Voluntary international renewable energy certificates I-REC (International Renewable Energy Certificate) confirm the information on the fact of electricity generation from a renewable energy source (RES) and by international practice (GHGP, CDP, RE100, ISO, etc.) allow their purchasers to declare the reduction of GHG emissions associated with the use of electricity under Scope 2.

In Kazakhstan, сompany issuing I-REC certificates is the Kazakh association ECOJER. In 2023 it issued 19.5 thousand green I-REC certificates for the Company Samruk-Green Energy LLP. It attracts financing to the companies for which they are issued. The Company sold 12 thousand certificates.

In 2023, JSC NC KazMunayGas purchased I-REC certificates and redeemed them for 10 million kWh, which corresponds to the expected electricity consumption of the Company’s corporate center in 2023.

Pillar Three: Infrastructure and regulation

The introduction of RES systems requires the development of power grid infrastructure and electricity storage and accumulation systems. We have started to implement some elements of Smart Grid technology. For example, KEGOC JSC is implementing a monitoring and control system based on synchrophasor WAMS/WACS technologies, which will maximize the use of grid capacity through real-time control.

Loads on power systems are uneven throughout the day, so maneuvering capacity is needed to cover peak loads.

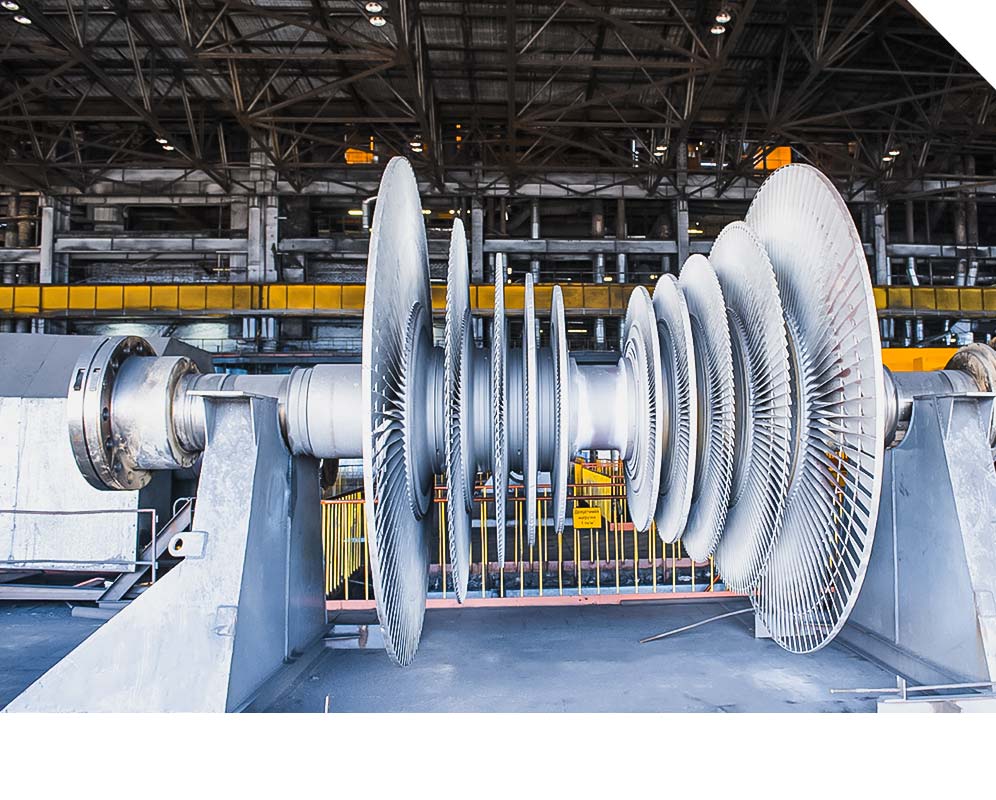

We are implementing projects to build the counter-regulating Kerbulakskaya HPP, Semeyskaya HPP with a capacity of up to 300 MW (counter-regulator of AES Shulbinskaya HPP). In addition, the construction of the maneuverable combined-cycle plant in Turkestan has been started.

Also, measures will be taken to strengthen the power grid of the Western zone and to reconstruct the power grid of the Southern zone of the EAU.

Pillar Four: Effective carbon footprint management

Effective carbon footprint management includes introducing digital carbon footprint solutions in the Fund and portfolio companies, broader data disclosure, implementing ESG principles in relationships with partners and suppliers, and strengthening environmental culture.

JSC NC KazMunayGas and JSC NAC Kazatomprom, Samruk-Energy JSC are implementing the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

Portfolio companies are implementing a number of measures as part of the Green Office: separate waste collection; reduction of paper use; use of LED lamps; environmental training for employees.

Several Group companies disclose climate information under the Carbon Disclosure Project (CDP), which includes data on direct and indirect greenhouse gas emissions for all company assets, climate risks and opportunities, and an assessment of the total carbon footprint of products. In 2023:

Climate risks

We identify climate risks using TCFD guidelines. Climate risks are included in the corporate risk management system and are categorized as environmental risks. The risk management system aims to timely identify, assess, monitor, and mitigate potential risk events that may adversely affect the achievement of strategic objectives.

Risks associated with the transition to a low-carbon economy GRI 201-2

Transitional risks

Political and legal risks

- Tightening of national and international carbon regulation

- Non-compliance with national environmental legislation

- Introduction of new climate initiatives that restrict business operations

- Control over compliance with the legislative norms in the field of environmental protection and compliance with the established deadlines for applying for emission permits and reporting to the state regulatory authorities

- Control over the use of GHG emission quotas and inventory of GHG emissions

- Implementation of the practice of disclosure of climate-related information, Risks and Opportunities by the requirements of the CDP and TCFD in portfolio companies

- Educate staff on legislative changes to expand/strengthen GHG reporting obligations

- Ensuring commercial attractiveness and payback of projects, which is currently constrained by tariff policies aimed at curbing growth

- Participation in working groups to improve the legislative framework for low-carbon development, energy efficiency and conservation, RES and alternative energy, taking into account corporate interests

- Utilization of the offset mechanism

Technological risks

- Need for low-carbon technologies and BAT implementation

- Scarcity of energy, raw materials and other resources

- Implementation of RES projects

- Realisation of forest-climate projects

- JSC NC KazMunayGas and Samruk-Energy JSC signed a Memorandum of cooperation on a project to build solar power plants

- Realisation of Smart Grid jointly with KEGOC JSC

- Research of CCUS technologies, hydrogen energy, production of sustainable hydrogen fuel

- Implementation of methane management system

- Interaction with state authorities and organizations on the development of the electricity and capacity market

- Increasing the gas resource base through geological exploration and new projects

- Financing and implementation of R&D program

- Compliance with the equipment modernization and repair plan

Market risks

- Reduced demand for fossil fuels

- Changing consumer preferences for certain climate-related goods, products, and services

- Ensuring a smooth and reasonable energy transition based on a reasonable balance between the pace of development of human civilization and ensuring ecological balance

- Gradual conversion of CHPP to gas

- Increasing the share of RES in power generation

- Transparent and competitive conditions for selecting investment projects and ensuring a high level of stability for investors

- Attracting investments that previously were mainly directed to the oil and gas sector development

Reputational risks

- Negative social impact as a result of abandoning the use of coal (5 single-industry towns and about 40,000 employees depend on the country’s coal industry)

- Lack of possibility of rapid reduction of fossil fuel consumption

- Ensuring a gradual and “fair” energy transition with job creation

- Membership in international associations and initiatives

- Obtaining ESG rating

Physical risks

Short-term Risks, caused by extreme weather events, such as cyclones, hurricanes, floods

- Abnormally high temperatures

- Destruction of production facilities, linear infrastructure due to extreme weather events

- Property insurance against damage (accidental loss, loss or damage) resulting from accidental and unforeseen direct physical impacts

- Ensuring control of readiness and duty of non-state firefighting services and emergency rescue services to eliminate possible accidents

- Switching to backup power sources in case of emergency power outage

- Transfer of equipment and machinery to summer mode

- Carrying out firefighting activities and fire safety drills

- Mandatory environmental insurance

Chronical risks, caused by long-term climate change

- Decrease in water levels in the Caspian Sea and rivers

- Construction of a desalination plant in the village of Kenderli

- Implementation of water supply projects in the western regions

- Remediation of historical oil contamination

- Monitoring of waterlogged and flooded wells

We have carried out modeling for three scenarios of the Fund’s development up to 2032 with the prospect of achieving carbon neutrality by 2060: Business as Usual, Decarbonisation, and Deep Decarbonisation.

The most optimistic of the scenarios is Deep Decarbonisation, which will achieve a 10% reduction in carbon footprint by 2032 from 2021 levels. This scenario assumes a faster energy transition through accelerated commissioning of nuclear power plants, with the first unit in 2032, increasing the share of RES and HPPs to 30%, increasing the electrification of motor vehicles to 19% and the share of electricity purchased from alternative sources to 45%.

Under the Neutral scenario (decarbonization), emissions can only be kept at the 2021 level. Under the Business as Usual scenario, the carbon footprint is projected to grow by 19%, as the scenario assumes the continuation of current trends in the Fund Group’s operations without a focus on decarbonization.

The direction of our low carbon development is fully aligned with the country’s “Strategy to achieve carbon neutrality by 2060”. In all scenarios, we are driven by the need to commission new capacity to avoid energy shortages in the country, with alternative energy, including nuclear generation, playing an important role in the transition of Kazakhstan’s economy from coal dependence.

Greenhouse gas emissions

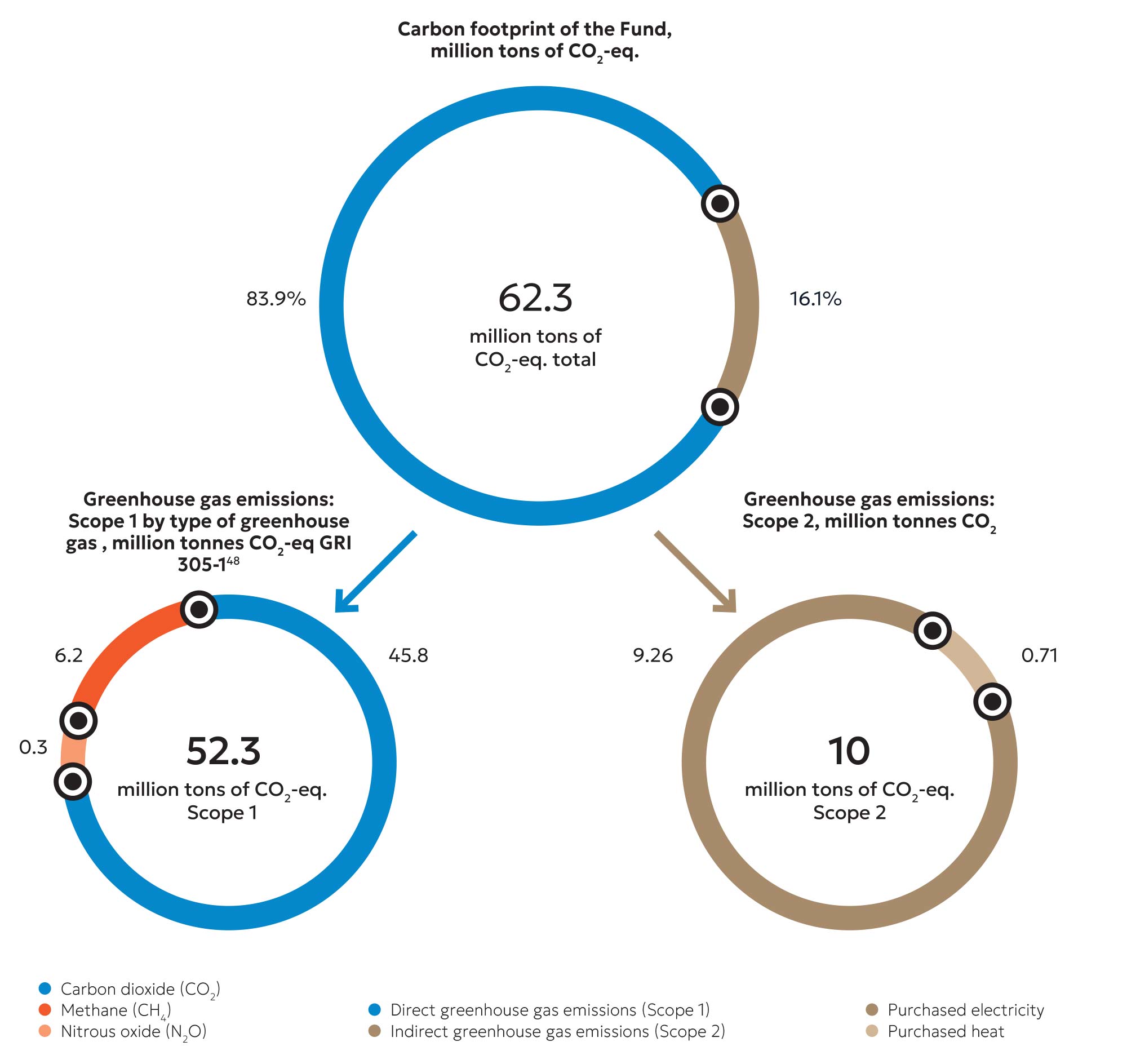

In 2023, the Fund Group’s carbon footprint (direct and indirect greenhouse gas emissions) was 62.3 million tons CO2-eq. Scope 1 greenhouse gas emissions were 52.3 million tons CO2-eq (3% growth by 2022). Indirect greenhouse gas emissions were 10.0 million tons CO2 (a decrease of 1%).

The largest emitters of direct greenhouse gas emissions are the electricity and heat generation sector — 32 million tonnes of CO2-eq (58%) and the hydrocarbon exploration, production, transportation and processing sector — 14.8 million tonnes of CO2-eq (28%). In these sectors, fossil fuels are extracted, burnt, and processed, and the emission volumes are the most significant. GRI 305-1

The largest share of indirect emissions is from purchased electricity (94%). The main emitters of indirect emissions are the oil production, transportation and refining sector (34%), the railway transport sector (31%) and the electricity transmission sector (25%).

Scope 3 emissions — all other greenhouse gas emissions arising in the company’s value chain, namely emissions from selling products (Category 11 — “Use of Sold Products”). The Fund’s Portfolio companies, such as JSC NAC Kazatomprom17F17F15F and JSC NC KazMunayGas18F18F16F are already calculating greenhouse gas emissions under Scope 3. JSC NC KazMunayGas discloses information on emissions under category 11 “Use of sold products”. Other Fund portfolio companies also plan to gradually develop reporting on Scope 3. GRI 305-3

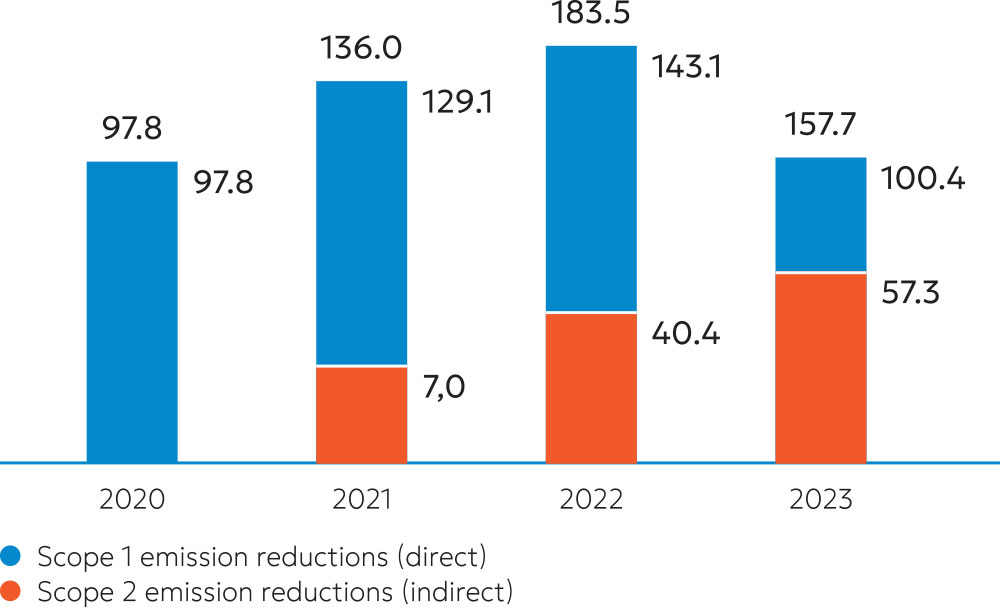

Reduction of greenhouse gas emissions as a result of measures aimed at reducing GHG emissions, thousand tonnes of CO2-eq GRI 305-5